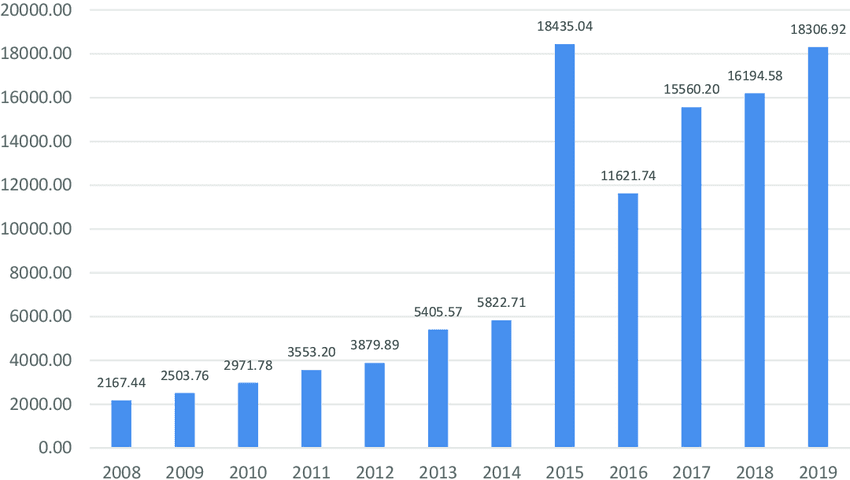

By 2022, remittances from the Netherlands to Ghana were a major economic driver. This prompted initiatives, like the IFAD/Ecobank PRIME Africa project, to enhance digital financial inclusion for recipients and cut costs for senders in the Ghanaian diaspora.

ROLE

UX Designer & Researcher

RESEARCH CATEGORY

Evaluative Research/ Generative Research

TOOLS

Miro, Type-form, Figma

We partnered with IFAD and Ecobank Ghana to rethink Ecobank’s current remittance solution and design engagements to adapt it for the Netherlands-Ghana remittance corridor while addressing the unique needs and challenges of both senders and recipients.

We began with stakeholder meetings to align on the scope and participant recruitment for our field studies. This preceded the discovery phase. Here, we conducted a series of activities to gain context and deepen our understanding of the remittance landscape.

Building Context Through Desk Research

Our desk research gave us a glimpse into the state of remittance within the Ghana-Netherlands corridor, particularly from the recipient’s perspective. Using reputable publications like the IOM Development Fund and GSMA we focused on these areas:

Recipient demographics

Location (urban and rural)

Purpose

Livelihood

Payment channels used

Notable Challenges

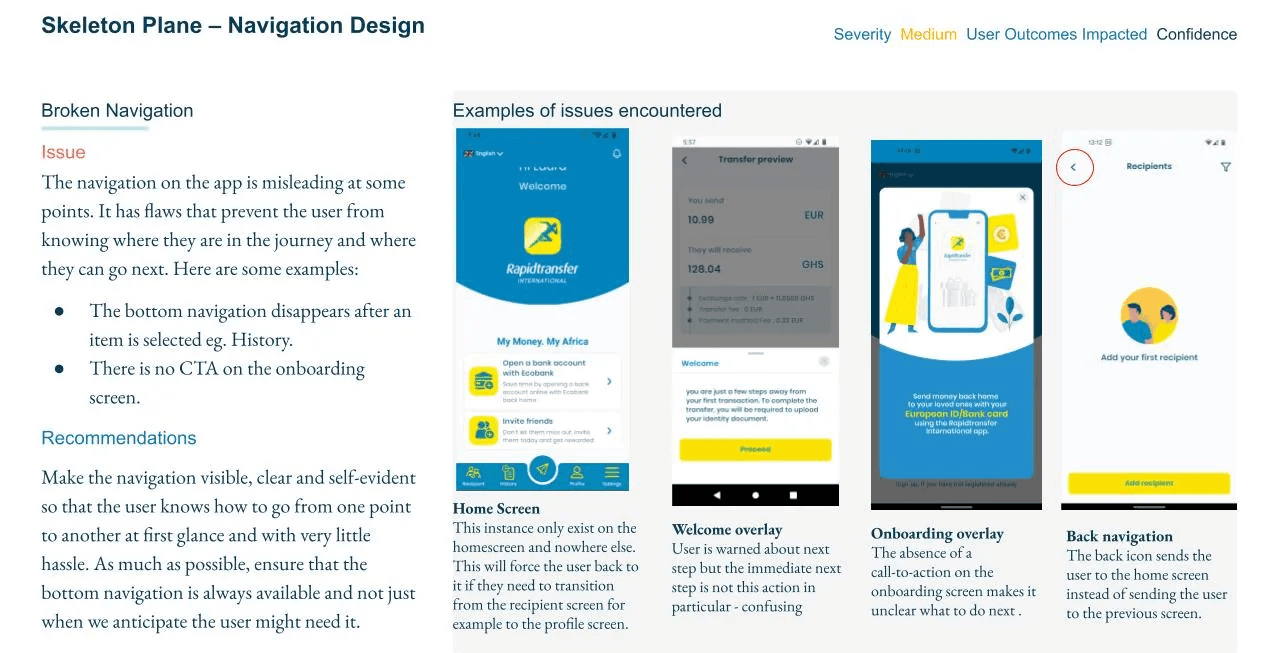

Expert Review of Current Solution

We assessed the effectiveness of Ecobank's current remittance solution by conducting an expert review on the Rapid Transfer International (RTI) app and offering recommendations based on our findings.

Understanding Frontline Realities

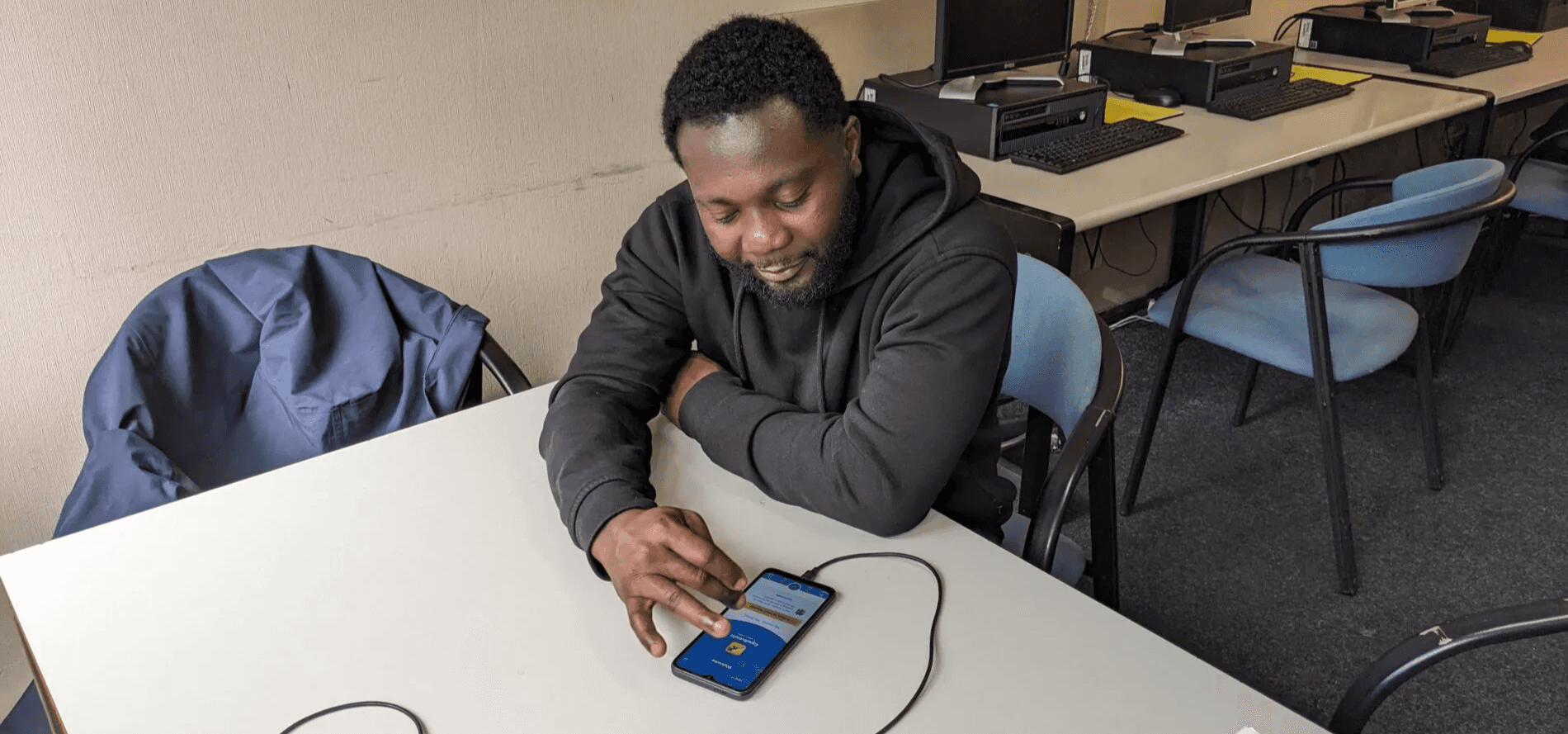

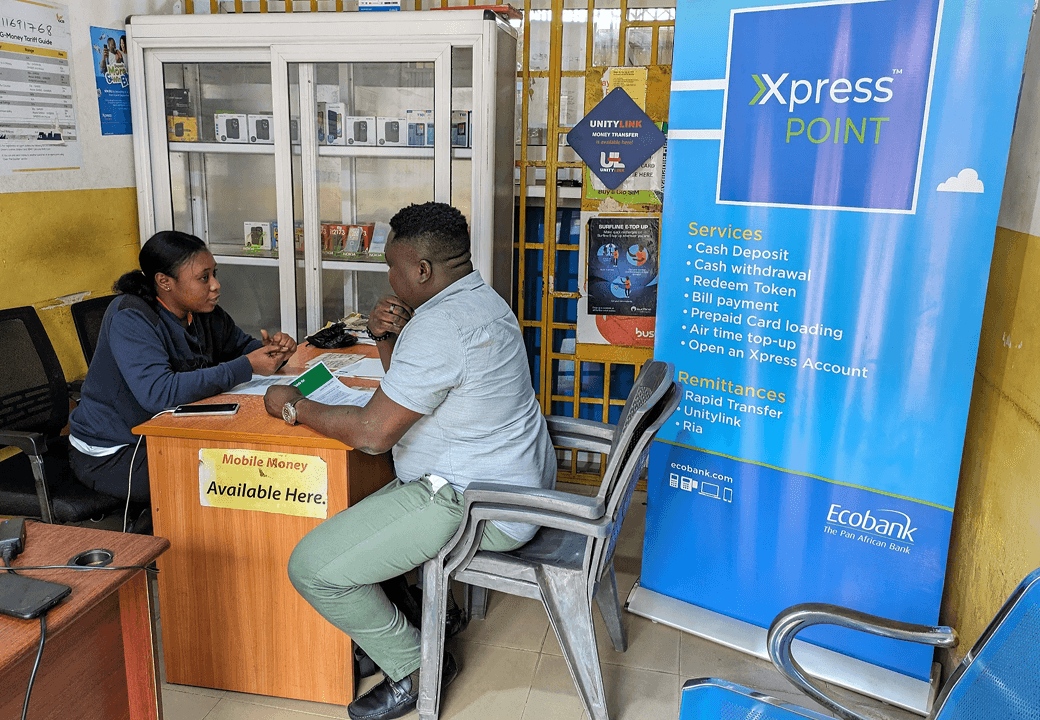

We conducted short, in-person interviews with Ecobank's frontline staff. Specifically, Xpress Point agents, in Ghana's urban and semi-rural areas.

We sought their perspective on remittance products and services, as well as the customers they serve.

Baseline Survey to Understand Senders

We conducted 300 multiple-choice surveys in 6 waves of 50 to assess the remittance channels used by Ghanaian migrants in the Netherlands.

Using indicators we defined in the survey, we also measured the impact of the RTI app and gathered insights into their technological competence and financial inclusion to inform our solutions.

This is useful in defining our subsequent design and marketing solutions

The Recipients’ perspective

We needed to validate core assumptions about Ghanaian remittance recipients. This included their income levels, their need for a micro-savings product, and the suitability of Ecobank Xpress Agents as channels for financial literacy training and promotion. Additionally, we had to uncover additional needs, pain points, and behaviours related to receiving international money transfers. Specifically, we aimed to:

Identify the channels recipients use and how often.

Understand the purpose of the remittances and how this affects their financial inclusion.

In total, we conducted 16 in-depth interviews with recipients in selected urban and semi-rural households.

Expert Review

Here are a few notable insights from our expert review:

Confusing Labels made navigation and task understanding difficult.

Broken Navigation prevented users from knowing their location or next steps.

Frustrating errors with unclear fixes likely increased drop-off rates.

Frontline Staff In-depth Interview

The following are insights from our engagement with frontline staff:

Most agents primarily serve customers receiving money from family and friends abroad.

High customer traffic means many agents are very busy and have little spare time.

Many Xpress points also receive training through partnerships with other banks.

Baseline Survey

Our baseline survey yielded the following key insights:

Demographics and Financial Status

Most participants were first-generation migrants who moved to the Netherlands seeking a better life.

Nearly 80% of these senders are low-income, earning under €1,500 monthly, and have low literacy levels.

Technology and financial Confidence

Majority showed a medium level of technology comfort.

Majority exhibited low financial confidence.

Remittance habits

Cash (79%) is the preferred payment method when using MTOs.

Mobile money (55%) is the preferred delivery method.

In-depth Interviews

Our IDIs yielded the following key insights:

Channel Preferences: Convenience vs. Constraints

Choosing a remittance channel is less about cost and more about control and habit.

Recipients often adapt to system limitations rather than seeking the ideal solution.

Financial Behaviour: Survival over Strategy

Recipients view remittances mainly as a lifeline, not an investment.

There is general distrust in the formal financial system for saving, leading semi-rural women to prefer informal savings methods.

Tech & Social Dynamics: Access ≠ Adoption

While smartphones are common, usage is basic.

Financial literacy gaps and gender roles hinder financial empowerment.

We held a series of ideation workshops to create solutions based on our insights. Following specific design principles, we would then prototype, test, and refine these solutions.

Ecobank's team and stakeholders were responsible for executing and scaling the final interventions. We ultimately created eight interventions, split between remittance senders and recipients.

Marketing Campaign

We proposed a marketing awareness campaign that embeds a financial literacy component via content marketing to promote Ecobank’s Rapid Transfer app, its download and trial among Senders, and increase their financial literacy.

Referral Promotion

To increase downloads and trials, we proposed an incentivised referral program for the RTI app, specifically targeting users with low digital literacy and limited prior referral experience.

Matching Promotion

We proposed offering a bonus percentage to encourage senders to deposit remittances directly into their recipients' micro-savings accounts via the RTI app.

UX Enhancements

We proposed a marketing awareness campaign that embeds a financial literacy component via content marketing to promote Ecobank’s Rapid Transfer app, its download and trial among Senders, and increase their financial literacy.

Micro-Savings Product

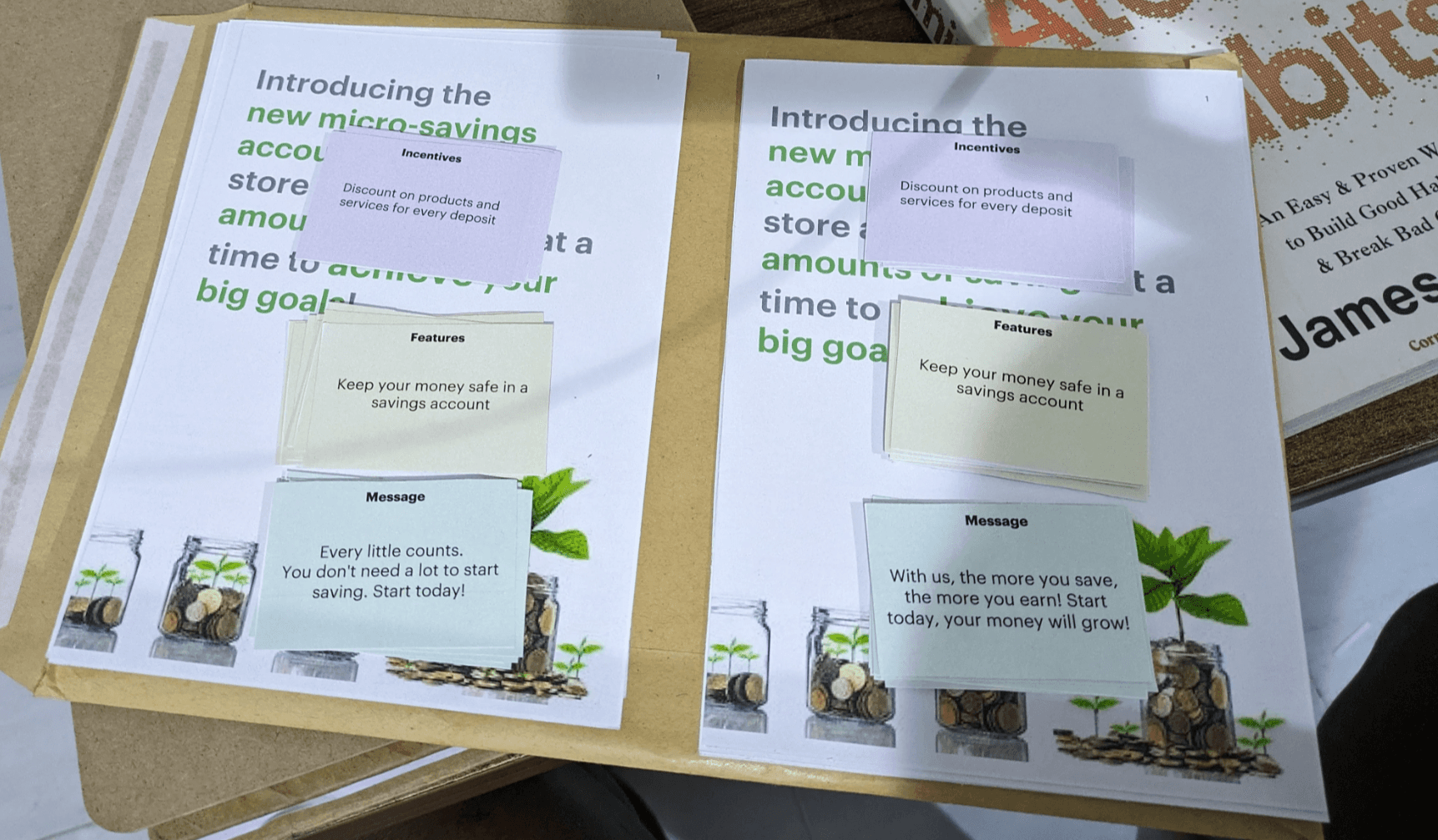

To help low-income remittance recipients save, we proposed that Ecobank offer a micro-savings product with no minimum balance or fees, plus a flat bonus for amounts saved. This concept was validated via a series of card sorting exercises.

Marketing Collaterals

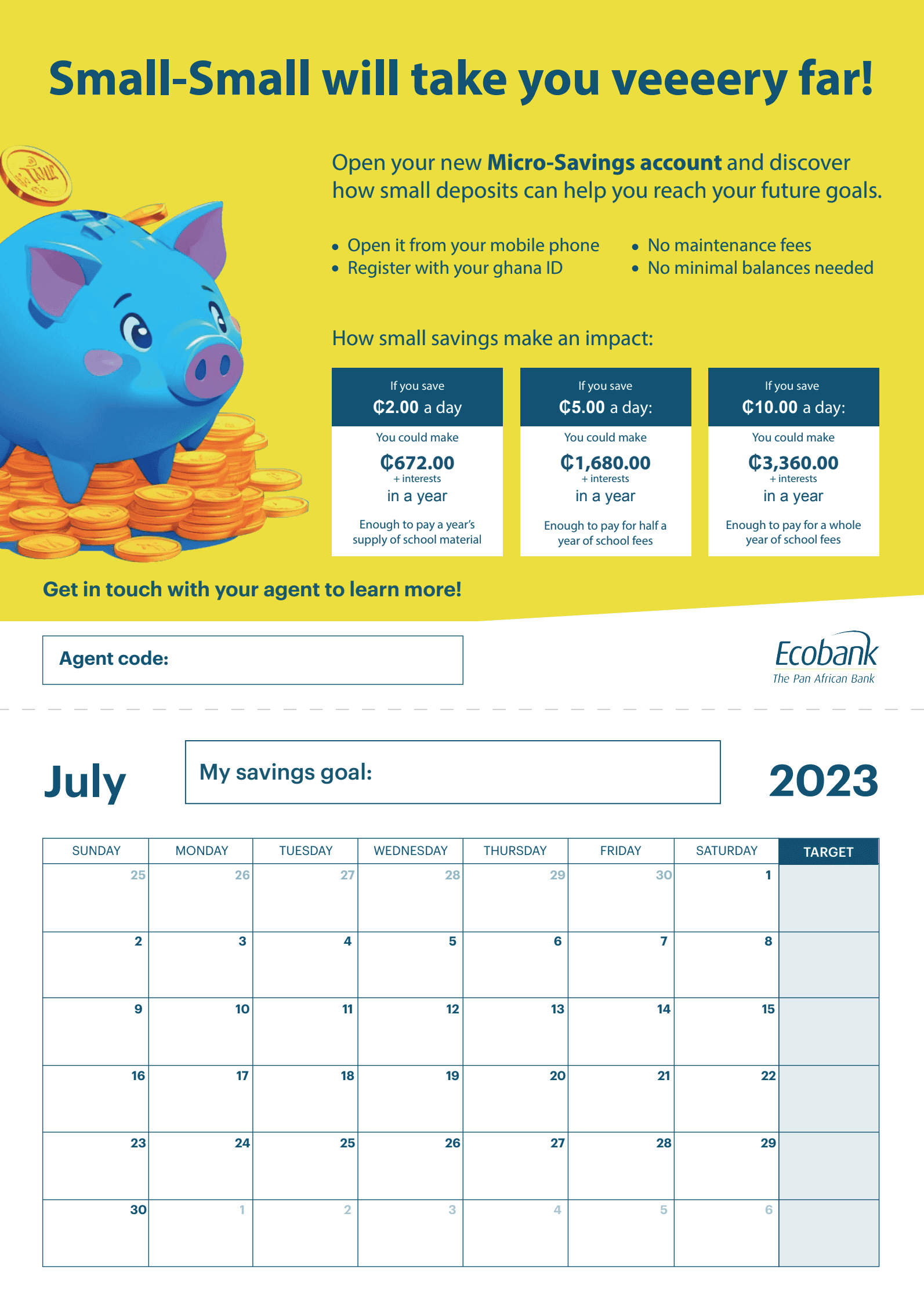

We designed and tested marketing materials through Ecobank Xpress Point agents to promote a micro-savings product and encourage recipients to open accounts.

Financial Literacy Program

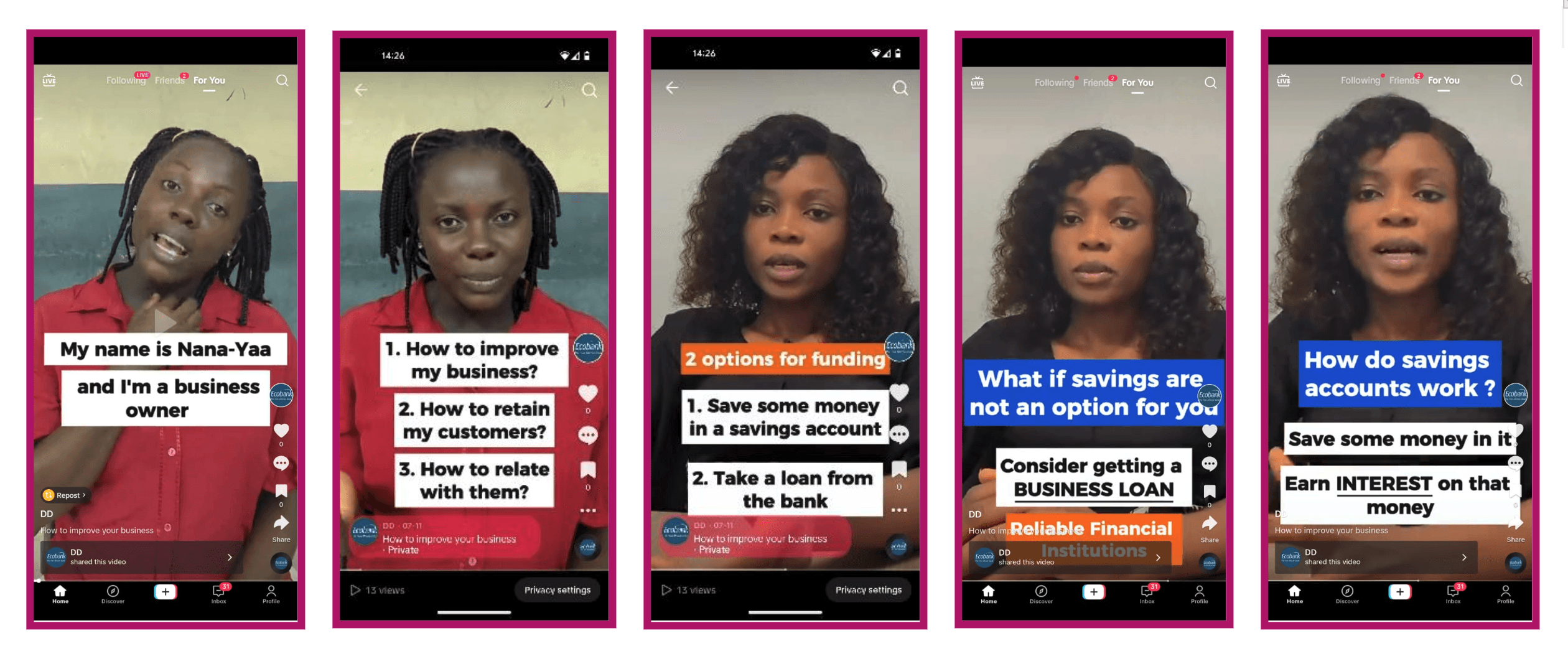

To equip low-income recipients with sound financial decision-making tools, we proposed a social media-based financial literacy program, prototyped as a weekly content on TikTok and Facebook. We also used card sorting exercises to determine which aspects of financial literacy resonated with the target audience.

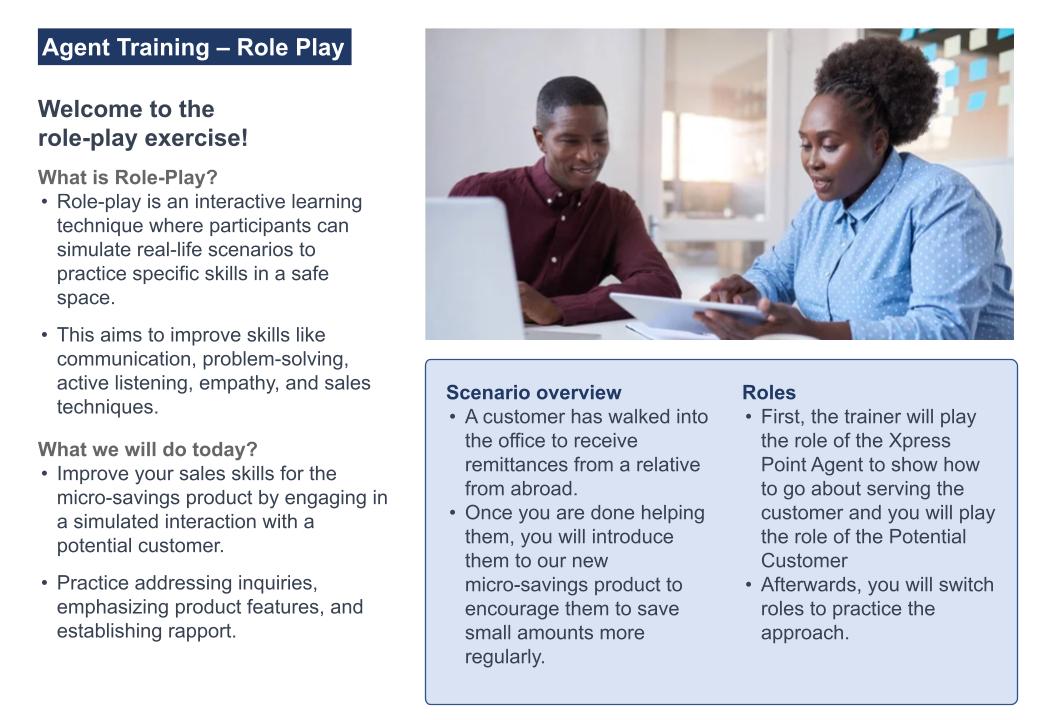

Agent Training Programs

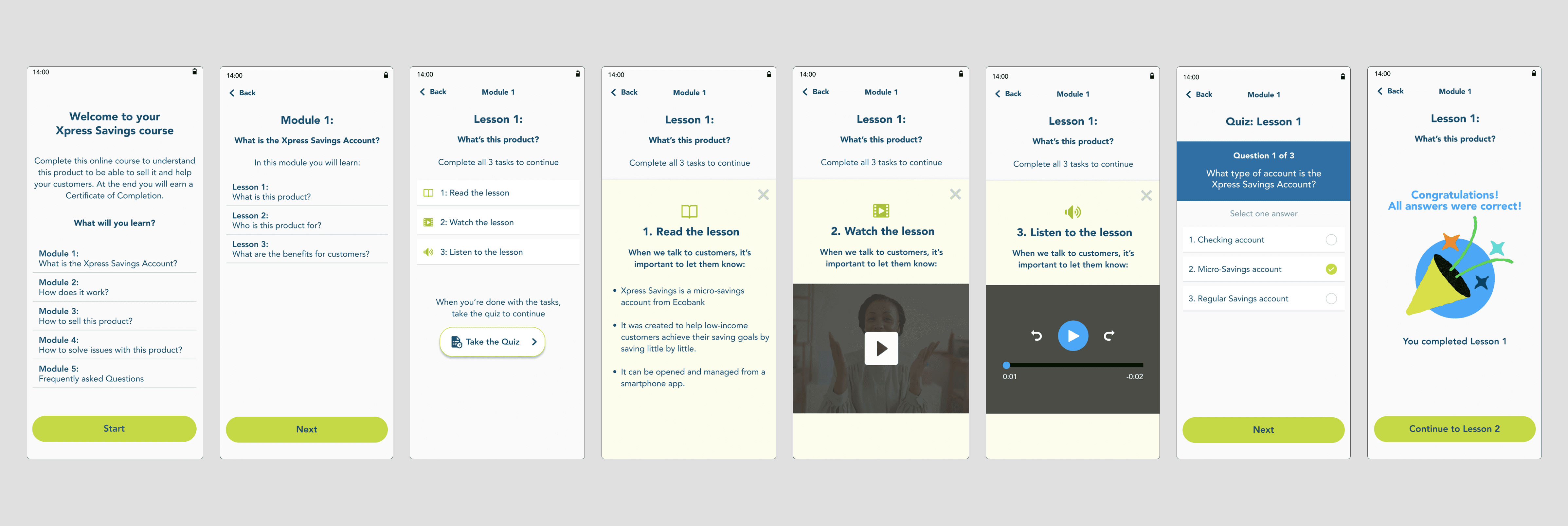

We prototyped and tested an interactive, mobile-based training platform and scenario-based role-playing to equip Xpress Point Agents to effectively explain and sell Ecobank's micro-savings product to walk-in customers

Mixed-methods approach

Integrating various research methods—from multi-country interviews and expert reviews to baseline surveys—taught me how to use a mixed-methods approach for robust design decisions.

Financial Services industry insights

My work in financial services remittance provided valuable expertise in user trust, security expectations, regulatory compliance, and designing robust, human-centered solutions.

Cross-Cultural Considerations

Conducting field studies in urban and semi-rural settings revealed that cultural differences critically shape user needs. This highlighted the importance of adapting messaging and experiences for diverse populations.